Flex Factor, Options Theory, Spread Trading Technique, Tactical Trading, Volatility Trading

The cornerstone of Modern Portfolio Theory is that Volatility Equals Risk. A similar concept exists in Pre-Modern Investment Theory: Safety Through Diversity. In the Pre-Modern example, diversification of assets leads to lower volatility by diluting outliers in the...

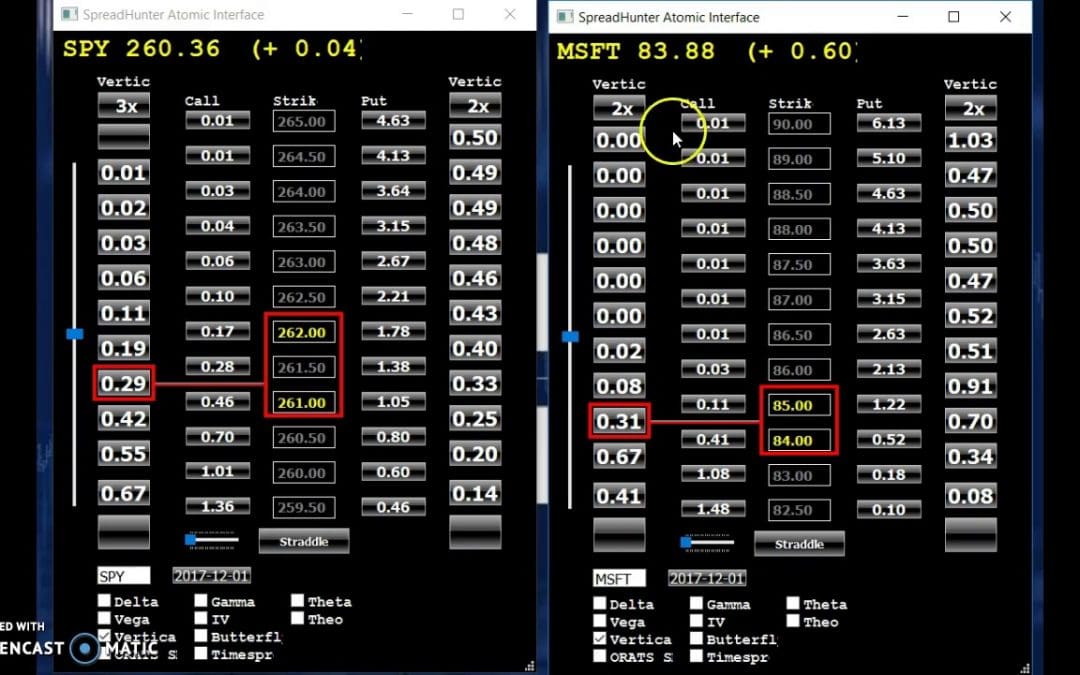

Options Theory, Spread Trading Technique, Tactical Trading, Volatility Trading

One of the most common ways that options traders lose money is a sudden, unexpected drop in historic or implied volatility. When this happens, strategies that once made money start losing money. And at the same time, risk from unforeseen “Black Swan”...

Recent Comments